Share This Page

Share This Page| Home | | Articles | |  |  |  Share This Page Share This Page |

Investment myths disproven

— P. Lutus — Message Page —

Copyright © 2020, P. Lutus

Most recent update:

(double-click any word to see its definition)

"My favorite time frame for holding a stock is forever." — Warren Buffett1When people invest in stocks, they often fall prey to a false belief, a belief I intend to demolish in this article. The belief is that paying a stockbroker2 to manage your money confers an advantage over direct investment in a no-load market index fund3. This belief is false, it's been proven false repeatedly, but the entire investment industry does all it can to keep you from discovering it.

Now that banks can legally pay almost no interest on individual accounts, the equities market is one of the few available ways to grow your money. But to do this effectively, consumers need to learn how equities work. Unfortunately, hiring a stockbroker is one of the most common, but possibly the least efficient, ways to invest your money.

In this article I explain how equity investment works, why it differs from most human activities, and how human instincts undermine the process.

Before we begin, I want to say something about American education. If Americans were educated in critical thinking4 and skepticism, in math and science, if we were taught how to think instead of being told what to think, stockbrokers would be out of work.

Let's get started!

The stock market5 is a way for businesses to raise operating capital. Simply put:

- Businesses have ideas and products but no money to develop them.

- Investors have money and want to make a profit by investing in ideas and products.

- The stock market brings businesses and investors together.

And:

- The value of a publicly traded company is only approximately represented by the value of its stock.

- People often buy stock in a company at a price that doesn't reflect the company's actual value — sometimes too high, sometimes too low.

- This means stocks aren't like money — their value is harder to establish.

- Unlike bank deposits, stocks have no insurance against loss — an investor can lose all his money because of a wrong choice.

These facts lead to a demand for stockbrokers, people who, for a fee, will steer unskilled investors away from beginner mistakes. But there's one beginner mistake a stockbroker won't help you with — the mistake of hiring a broker.

Professionals measure stock market performance with what is called a "market index"6. One example is the Dow Jones Industrial Average (DJIA)7, another is the S&P 500 Index8, these indices serve different needs. Their purpose is to provide a measure of the overall market, rather than track changes in a single market sector or industry.

Unlike individual stocks, market indices tend to change slowly over time, reflecting broad market trends rather than short-term changes that can make a particular stock's value fluctuate in a seemingly random way.

The Efficient-Market Hypothesis (hereafter EMH)9 is an idea that asset prices reflect all available information, with the implication that no one can craft a strategy to "beat the market".

The EMH is a bit technical and mathematical, but it's possible to describe some implications in everyday language, for example if a strategy were devised to improve on average market returns, it would be universally adopted and would consequently become the new market average.

It's important to say that the EMH is a hypothesis, not a scientific theory supported by evidence. This is partly because markets are difficult to study reliably and partly because the EMH doesn't have a clear mathematical definition such as one finds in more rigorous sciences like physics.

Some market studies suggest that the EMH reflects reality. One example is the Wall Street Journal "Dartboard Contest" discussed in the next section.

In 1988 the Wall Street Journal10 began a contest that compared professional stock traders with darts thrown randomly at a list of stocks. The idea of the 14-year Dartboard Contest11 was to see if the professionals could pick stocks better than randomly thrown darts.

At first glance the professionals showed a small edge over randomly picked stocks, except for two factors that are often cited by the contest's detractors:

- The "Announcement Effect"12 tends to bias subsequent returns of a stock picked by professionals (the WSJ published all the brokers' picks).

- For an individual investor, stock picks made by professionals are accompanied by transaction and brokerage fees and the tax implications of frequent stock trades. If included in the tally, these factors more than wipe out the small edge the professionals showed over random picks and market indices.

In a now-classic study published in 200013, economists compared the performance of brokered portfolios against index fund accounts. The study concluded, "Individual investors who hold common stocks directly pay a tremendous performance penalty for active trading. Of 66,465 households with accounts at a large discount broker during 1991 to 1996, those that trade most earn an annual return of 11.4 percent, while the market returns 17.9 percent."

Compared to the Dartboard Contest this study is more likely to reflect reality because the previously discussed Announcement Effect was not a factor. On average, the subjects with actively traded brokerage accounts lost 6.5 percentage points compared to the returns one should expect by passively investing in an index fund.

Based on these studies, we can say:

- The Efficient Market Hypothesis suggests no one can beat average market returns.

- Evidence for the EMH is that market professionals — stockbrokers — cannot outperform the average market.

- The cost of a broker's services — sales commissions, maintenance fees and the tax burden created by frequent stock transactions, puts the broker's client behind average market returns:

Can Anybody Beat the Market? (Investopedia)14 — "Yes, you may be able to beat the market, but with investment fees, taxes, and human emotion working against you, you're more likely to do so through luck than skill. If you can merely match the S&P 500, minus a small fee, you'll be doing better than most investors."

Albert Einstein said, "Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it."15

Without understanding compound interest16, readers may not understand how and why brokerage commissions and fees increasingly erode market returns over time.

Compound interest affects financial accounts (bank accounts, mortgages, stock portfolios) where past gains are included (compounded) with present gains. For example, let's say that a town has a population of 10,000 people and that population increases 1% per year.

Without an understanding of compound interest, common sense says it should take 100 years to double the town's population:

- Initial population: 10,000

- Annual growth rate: 1% (0.01)

- Years: 100

- Based on those numbers, one might think the future population (FV) should be the present population (PV) times the sum of 100 years (NP) of 1% growth (IR), or: \begin{equation} PV \boldsymbol{\cdot} (1+IR \boldsymbol{\cdot} NP) = FV \end{equation}

Where:

- PV = Present Value

- FV = Future Value

- IR = Interest Rate per period

- NP = Number of Periods

or:

\begin{equation} 10,000 \boldsymbol{\cdot} (1+0.01 \boldsymbol{\cdot} 100) = 20,000 \end{equation}- But equations (1) and (2) don't correctly predict the outcome. The reason? Simply put, children have children of their own. And those children have children, ad infinitum. In just the same way, money begets money.

- In nature (including equity accounts), new population multiplier terms are applied to the accumulating result of old multiplier terms, meaning growth is compounded over time. That analysis leads to this equation: \begin{equation} PV \boldsymbol{\cdot} e^{IR \boldsymbol{\cdot} NP} = FV \end{equation}

With a new mathematical term $e$, the base of natural logarithms17.

Now let's look at graphs that compare linear growth (equations (1) and (2) above) with compound growth (equation (3) above) (click the chart to see more examples):

Click image for more examples

This result means that, given a 1% per annum population increase, the town's population would double in 69 years, not 10018.

So it seems compound interest is a powerful force — over time it produces non-intuitive outcomes. Let's explore this idea.

In this section we compare the long-term performance of an account that tracks a market index — an "index fund", described earlier — versus a brokered account, the latter of which includes commissions, management fees and other costs.

It's important to understand how an index fund differs from a brokered account. An index fund shouldn't have any significant fees, because management is neither required nor desirable. By contrast, a brokered account necessarily includes sales commissions, maintenance fees, and a more complex tax environment with costs of its own.

Remember, as we have shown above, a brokered account cannot outperform the market — the same market the index fund represents.

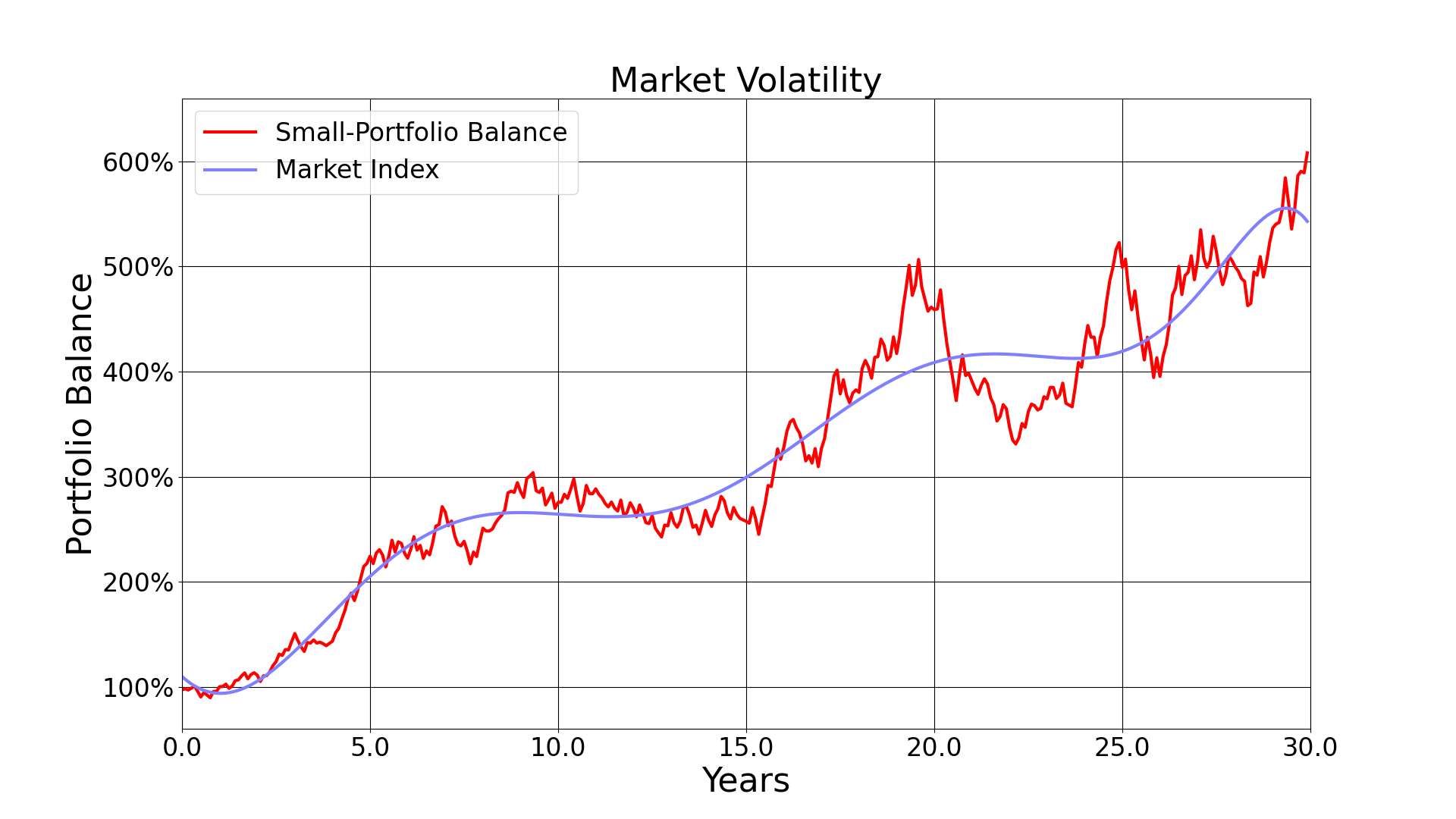

Here is a set of charts that reveal how an index fund outperforms a brokered account over time, helped along by compound interest. In this model the market increases in value by 7%/annum while brokerage combined fees are 2%/annum, typical figures in modern times.

This comparison makes the optimistic assumption that an index fund and a brokered account create the same annual growth before fees, even though studies dispute this (brokered accounts do worse on average). So the only difference between the charted outcomes is brokered account commissions and fees, and the tax implications of frequent trading. Click the chart to see more examples in the series:

Click image for more examples

In this example the initial difference in return between the index fund and the brokered account is only 2 percentage points, which represents typical brokerage fees and other costs. So in the first year an index fund returns 7% while the brokered account returns 5% asset growth. Two percentage points — that doesn't seem terribly important, does it?

But as the years go by and as compound interest works its magic, the difference between the two accounts becomes more dramatic. After ten years the index fund has grown 22% more than the brokered account. After 30 years it's 82% larger and after 50 years it's 172% larger — all because of compound interest.

What conclusion can we draw from this?

Some investors want excitement, risk, the thrill of beating the market, if only for a while. Because of chance factors, this strategy works about 1/2 the time, sort of like flipping a fair coin — 50% heads, 50% tails. But as shown above, this active-portfolio strategy eats into long-term gains, and the greater the activity level, the greater the loss. The worst performers are day traders who constantly buy and sell, sometimes hourly — overall, their portfolios perform worse than a trip to Las Vegas.

An investment strategy must rely on what the investor wants to achieve. If making money is the point, then take Warren Buffet's advice19: buy a wide, diverse assortment of stocks and sit on them — the classic Buy & Hold strategy.

As it happens, there are now funds called "index funds" that track market indices, indices designed to represent the entire market, without a focus on any particular segment. Index funds also correspond to the advice of seasoned investors: avoid too much concentration in any single economic activity or market segment. Index Funds are also the least expensive funds because there are no management costs or sales commissions.

If index funds are such a good deal, why do stockbrokers so often advise against them? Simple — naked self-interest, our next topic.

Stockbrokers cannot survive if you choose index funds and similar low- or no-load investments, so they invent bogus arguments against them. Here's a typical stockbroker argument:

3 Reasons Not to Invest in Index Funds (Motley Fool)20:

- (1) "Index funds are designed to match the stock market's performance. If your goal is to beat the market, then index funds aren't for you. Rather, you'll need to hand-pick individual stocks or mutual funds that are likely to outperform major indexes like the S&P 500."

Studies like the WSJ Dartboard Contest show that even trained professionals cannot beat the market by hand-picking stocks, and the EMH argues this is not possible.

Also, if a reliable method existed to beat the market, everyone would practice it, and it would become the new market average, the average that index funds track.

Finally, as shown above, an active portfolio incurs commission, management and tax costs that make it fall behind an index fund.

- (2) "When you buy index funds, you don't get a say in what goes into them. An S&P 500 index fund, for example, will give you exposure to the 500 largest stocks by market capitalization. If there are a dozen or so stocks in there you don't like, you're stuck with them."

Market index funds are designed to represent the entire market, which avoids the beginner's mistake of concentrating too much capital in any single market segment. For example, as gas-powered cars are replaced by electric cars, the index fund investor continues to make money, because an index fund includes both sectors.

But if you take Motley Fool's advice and directly invest in electric cars, you will discover that train has left the station (meaning other naïve investors have already bid that stock up to an absurdly high price).

- (3) "One major benefit of index funds is that by adding them to your portfolio, you automatically get a diverse mix of stocks. But if you feel confident in your ability to research stocks individually from a wide array of market sectors and amass a suitable mix on your own, then there may not be a need for you to fall back on index funds."

- Apart from being a restatement of argument (1) above, if an investor were to choose the right mix of stocks to avoid beginner's errors, (s)he would end up with a portfolio indistinguishable from an index fund. And buying and selling stocks based on one's "ability to research stocks" means paying commissions and management fees, which would undermine the imagined advantage to the strategy.

My point? Arguments against index funds are frequently illogical and seem written to appeal to naïve, inexperienced investors who think they can beat the market. And they can — about half the time. But in the long term and for reasons already given, the actively traded portfolio falls behind the buy & hold portfolio.

Also, inevitably, such arguments are made by people who sell brokerage services, people whose bias and self-interest are obvious.

To someone trained in critical thinking, the very existence of stockbrokers represents a logical contradiction. The stockbroker claims to be able to invest your money more efficiently than you could do on your own. But if that were true, if the stockbroker really had special knowledge that could beat market averages, he would use that knowledge to invest his own money directly and become rich that way.

The fact that the stockbroker is offering his services for a fee means he can't make a living based only on his own knowledge of the stock market, so he needs your money to stay afloat. This means there are no "Secrets of the Winners," and if there were, the stockbroker doesn't know what they are, because if he did, you would never hear from him.

On the topic of secrets ...

There are any number of books with titles like "Secrets of the Winners". They only sell because people aren't trained in critical thinking:

- There are no "Secrets of the Winners." If there were, the secret would get out, everyone would practice it and the result would be reflected in market averages, so everyone would benefit from the non-secret including people who invest in index funds.

- The fact that someone has to sell a book titled "Secrets of the Winners" means the secrets didn't work for him, unless the real secret is to sell a worthless book.

- Not to state the obvious, but if it's in a book, it's not a secret.

Miracle Man

Stockbrokers have any number of devious ways to make themselves look good, by for example describing their track record without providing a time context (at any given moment, half of stockbrokers are ahead of the market and half behind). Or they can mislead by promising returns without disclosing their brokerage fees and other costs. But there are some world-class deceptions in the stockbroker's world, tricks that successfully deceive educated people. One of the most convincing scams is called "Miracle Man." Here's how it works:

- On May first you receive an email from Miracle Man. In the email he predicts the stock market will either rise or fall during the next month. At the end of the month, the prediction has come true.

- For six months you receive an email with a Miracle Man market prediction, and each of the predictions comes true.

- The emails all arrive weeks before the changes they predict, and the predictions aren't about just a few stocks, but the entire market.

- After six months of accurate predictions, it comes to you that had you moved your assets according to Miracle Man's predictions, you would have become a millionaire.

- On November first, you receive another email that summarizes the six months of perfectly accurate market predictions and asks you to sign your investment portfolio over to Miracle Man.

I emphasize again that Miracle Man is a trick, a scam, it's not real. Even educated people have a hard time imagining how someone can mail six months of perfectly accurate market predictions in advance of the time they predict, without actually having special skills or knowledge.

Before reading ahead, ask yourself — how does Miracle Man do it?

The Miracle Man scam is very persuasive to those untrained in critical thinking and skepticism, but it's as simple as it is effective. In fact, a computer can generate the prediction emails without the assistance of a human. Here's how it works:

- Miracle Man acquires a large email address list, the larger the better. In modern times, large address lists are easily acquired.

- Miracle Man divides the address list into two equal-sized daughter lists. He tells one list the market will rise, the other list that the market will fall.

- At the end of the month, Miracle Man discards the list that got an incorrect prediction, splits the correct-prediction list in two, and repeats the process from (2) above. Each month's activity reduces the list size by 50%.

- At the end of six months Miracle man has a much smaller list of addresses, but each has gotten a seemingly miraculous series of market predictions. He sends one final email to that list, asking for control of the recipient's portfolio.

So it's a scam, a trick, devious and convincing, but to someone trained in critical thinking, there are some pretty obvious red flags:

- If someone could predict the market in advance with perfect accuracy, that person could corner the market, drain it of its capital, and businesses would refuse to raise money using stocks — the market would collapse. But the market hasn't collapsed, so something is rotten in Denmark.

- If someone could predict the market like Miracle Man appears to do, that person wouldn't need your money to become rich, he could get rich using his own funds. But for some reason Miracle Man wants to control your money, so (again) something is rotten in Denmark.

- A general word of warning: if someone appears to have advance knowledge of the market, be very careful following their advice, because many advance predictions turn out to be based on non-public insider knowledge, and trading on such knowledge — "insider trading"21 — is illegal and is aggressively prosecuted.

Miracle Man is only one of dozens of stock market scams, all of which prey on people's naïveté and inexperience. One can learn all the tricks and remain vigilant, or one can refuse to actively trade. The latter strategy has advantages beyond avoiding scams, like maximizing profit potential.

Investors need to ask themselves why they want to invest in stocks. If they seek risk and excitement, they can become day traders and lose all their money. If they feel charitable and want to help a stockbroker send his children to college, they can open a brokerage account. But if their purpose is to make money, then they should look into no-load index funds — it's really as simple as that.

People outside the brokerage industry overwhelmingly recommend the Buy & Hold strategy. These people don't need to become stockbrokers or sell get-rich-quick books, because they already have money. They already have money because they know how to invest.

Doubts about the EMH

| Home | | Articles | |  |  |  Share This Page Share This Page |